Objective

- Delinquency likelihood of the accounts.

- Assess expected losses on the delinquent accounts (DQ).

- Rank the accounts by severity in order to prevent severe losses.

Behavioural scorecard for a leading US Bank to predict.

Solution

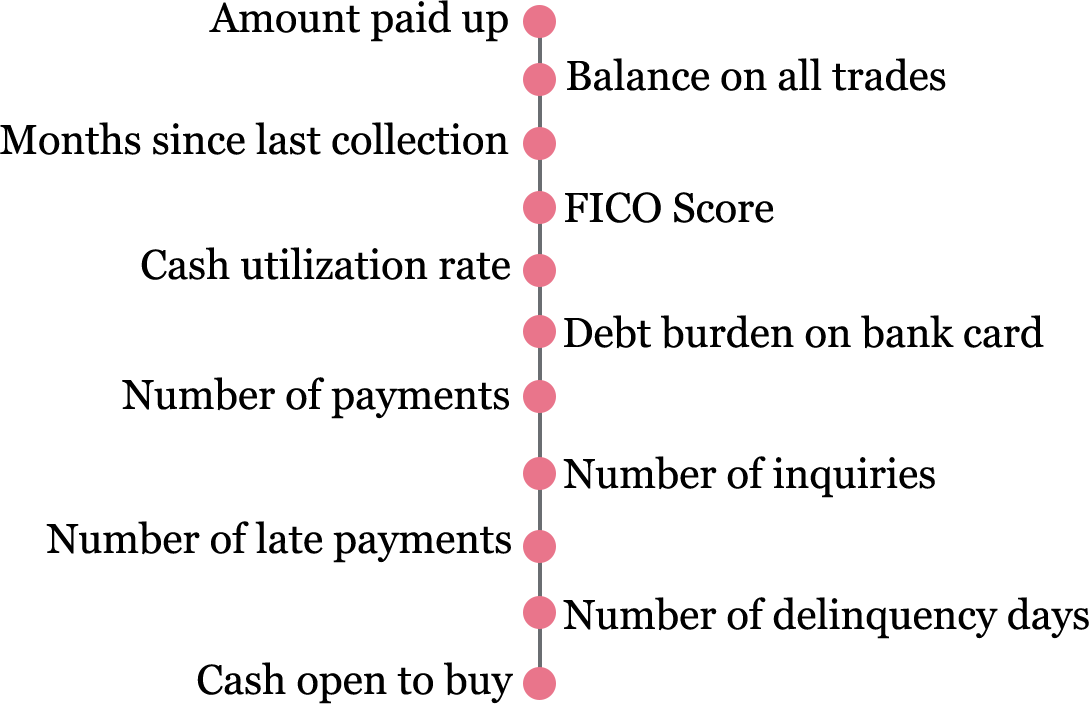

- Variable screening using both statistics and business acumen. Iteration with different subset of variables is supported by Smart tool.

-

Determination of optimal probability cut off to obtain low error. In the validation sample, the model achieved very low error rate minimizing the cost arising from both type of errors – an attractive feature of ScoreBuilder, to make the decision.

False positives: Non-DQ accounts misclassified as DQ – Collection costs - 5% False Negatives: DQ accounts misclassified as Non DQ – Loss incurred as no action was taken - 8%

- High discriminatory scorecard as evident from the KS Statistic value of 0.63.

- Benefited the bank to lower losses by xxx%.