Objective

- Assess the likelihood of default.

- Expediate the application process resulting in expanded business in this sector.

Application scorecard for Small and Medium Enterprises (SME).

Solution

- TTD population was used for model with reject inference.

- Classification of risk factors for better understanding the magnitude of risk.

Moral Risk

- Company Reputation

- Management Experience

- Reference

- New/Existing Client

Business Risk

- Type Of Business

- Location / Property

- Years Trading

- Utilization

- Loan Objective

Financial Risk

- Financial Index - Trend and Forecast

- Liquidity Ratio

- Leverage Ratio

- Profitability Ratio

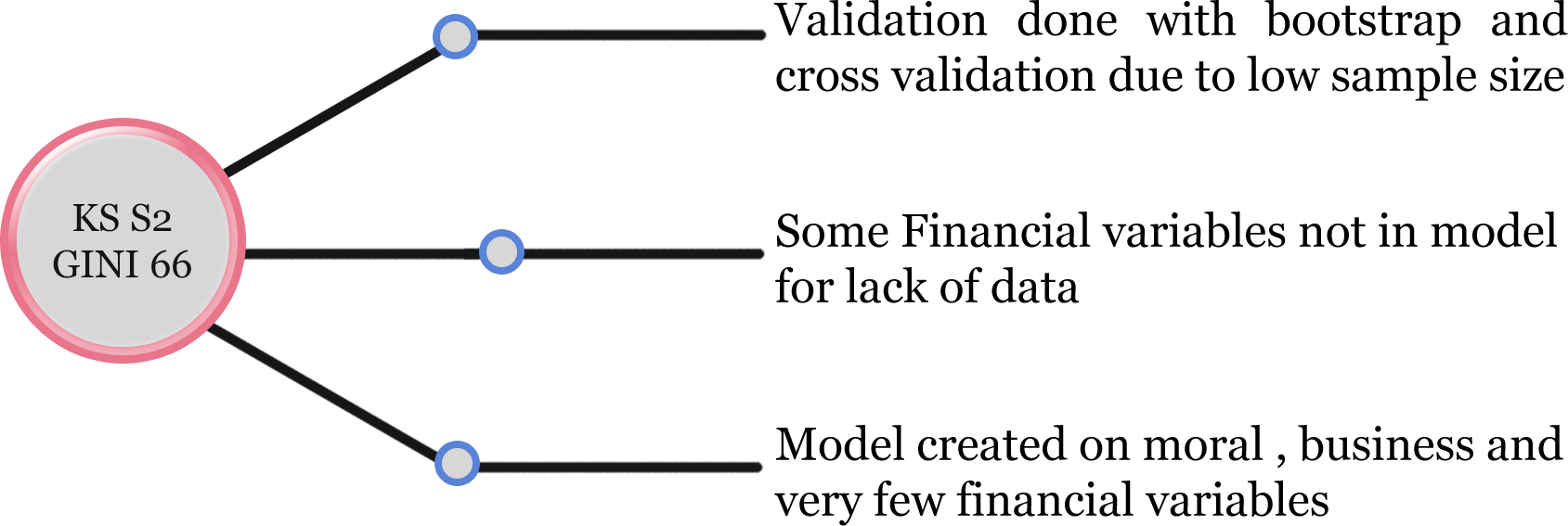

Challenges

- Not enough application data to develop model.

- Classification of risk factors for better understanding the magnitude of risk

Benefit

- The initial model expediated the loan process resulting in xxx% increase in business with excellent separation between good and Bad classes.

- After couple of years the model was recalibrated with financial variables – The result was outstanding with KS 58 and GINI 72 indicating a high performing model. Bank shifted to a scorecard generated loan application process.