Objective

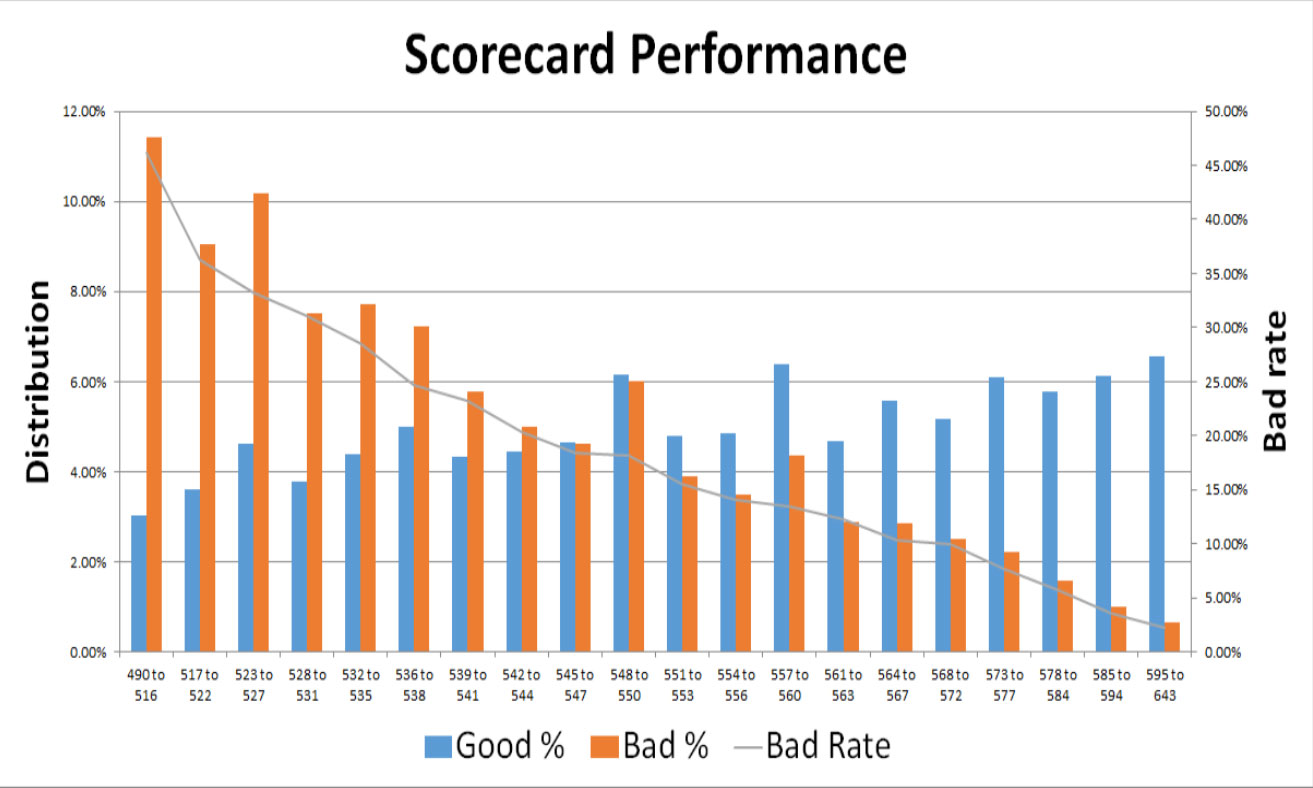

- Review and recalibrate scorecard.

- Use insight data to improve alignment between underwriting rules and scores.

Application scorecard for sub-prime customers.

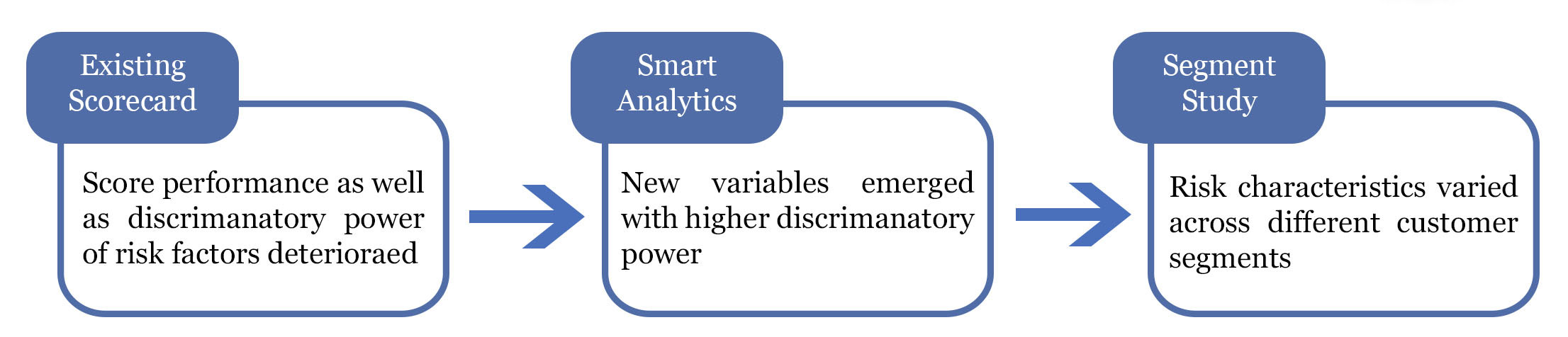

Solution

- Data collation to align all variables from same time-period was carried out using R for analysis.

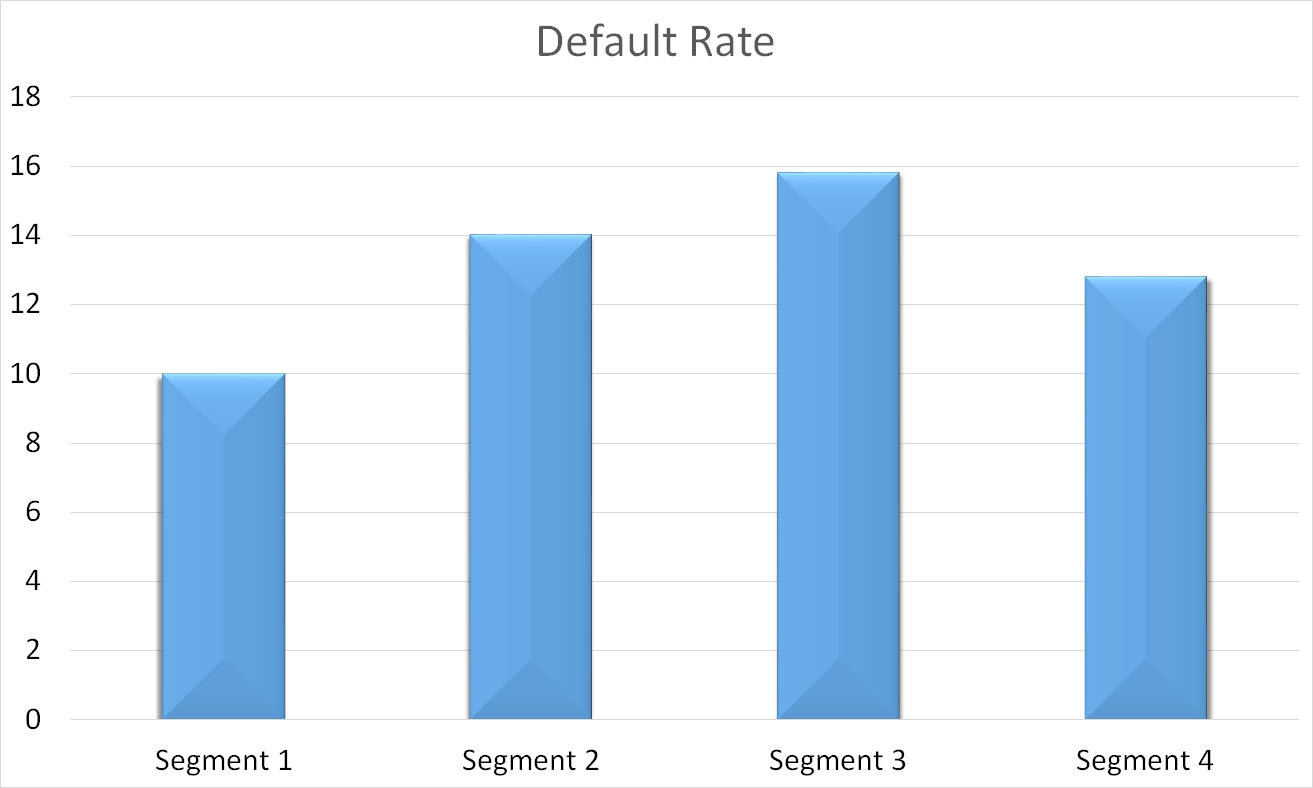

- Customers classification using domain knowledge and statistical methods – Decision tree and cluster analysis.

- Multiple scorecards each with superior performance than existing scorecard

- All scorecards rescaled to have similar odds.

- Scorecard as a linear function for easy integration with loan origination system

- Reviewed underwriting rule and corporate reporting system and recommended changes.

Challenges

- Methodology for current scorecard not well documented

- Scores not aligned with underwriting rules

- Data in batches – Credit history, product information, loan terms in different files from different time periods

- Performance available only for 8% TTD population who take up loan from 55% approval